As digital financial solutions and mobile money become more common in the Caribbean region, how can T&T leverage its investment into its telecom infrastructure to meet the needs of the underbanked and unbanked?

This was one of the compelling questions posed to panellists at the Caribbean Telecommunications Union’s 19th Caribbean Ministerial Strategic ICT Seminar on “Leveraging Global Partnerships for Caribbean Connectivity” in the Bahamas.

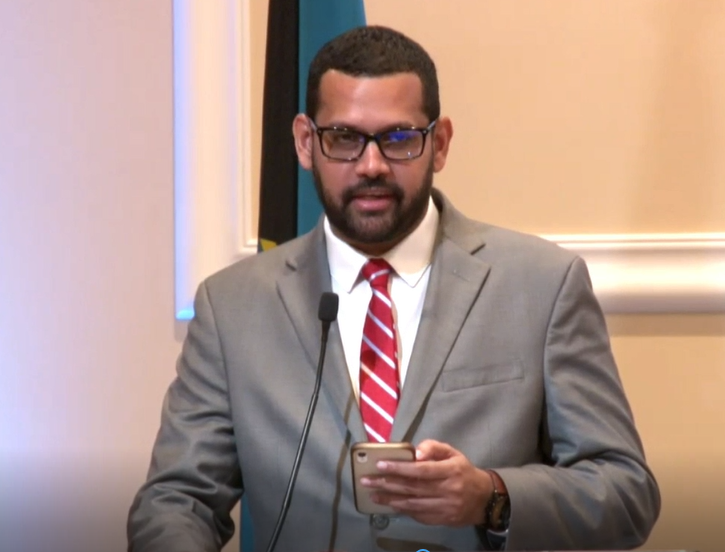

During a panel discussion moderated by Mr. John Outridge, Chief Executive Officer of the Trinidad and Tobago IFC on “FinTech – The Role of Telecommunications in Advancing Financial Inclusion,” he began the discussions by challenging the panellists with the following question: “With the significant investment over the years in telecom infrastructure, how can one leverage this to do more than connect people with their family and friends?”

In response to this question, the panel noted that even though there are strong financial, ICT and telecom sectors in the Caribbean region, the opposite is true as it relates to the rate of adoption and usage of digital finance and banking solutions, especially where there is significantly high access and usage of mobile devices. While telecom providers are stepping up to provide digital financial solutions, progress varies across the region as each territory is at a different stage of its development. There is also a rise in central bank digital currency (CBDC) across the region, but access and full usage are not fully realized.

The panellists also discussed infrastructure inconsistencies, such as unstable electricity supply, high fees, and credit availability, as factors contributing to low adoption rates and an increase in “voluntary financial exclusion,” which are barriers for consumers outside of the existing banking system to adopt mobile financial payment solutions.

To address this, the panel recommended the provision of robust public education initiatives, online and telephone support systems, and zero-rated or credit-free solutions allowing mobile wallets to operate offline (when there is no mobile credit from data plans or no electricity) as effective measures. Additionally, the panel recommended the provision of strong regulatory systems to strengthen consumer protection and simple but effective digital KYC systems.

Noting the challenges around de-risking and AML/CFT compliance, the Carib Dollar is one emerging development in the pipeline as a complimentary currency using blockchain technology. It will not replace or eliminate local currency, but will allow for an increase in trade and cross-border business activity as a result of the ICT and telecom infrastructure.

In Trinidad and Tobago, the TTIFC has been working over the last year with GORTT’s Ministries, Departments, and Agencies (MDAs) and regulators to address the issue of financial inclusion and how to get citizens into the formal economy, reduce the usage of cash and improve the ease of doing business by both the consumers and business community. One of the ways TTIFC has done this is by providing support to revenue-collecting agencies and departments of the government through the development and deployment of electronic funds transfer or EFT consulting solutions to encourage and facilitate the digitalization of payments across the public sector. This was done with the aim of ensuring that there are standard EFT instructions to leverage ACH solutions across government.

In addition, to yield returns on our telecom infrastructure investment, the TTIFC is partnering with the sector to enhance efficiencies across the public sector and the broader financial services to address the issues that contribute to the levels of voluntary exclusion that we experience in T&T currently.

Contributor to the panel discussion: Ms. Helen Gradstein (Remotely), Head – Eastern Caribbean Office & Regional Digital Finance Specialist – UN Capital Development Fund (UNCDF), Mr. Richard Douglas, Chief Executive Officer / Co-Founder – Island Pay, Bahamas and Dr. Jan Schröder, Chief System Architect – CaribCoin.