FinTech is providing opportunities for transforming the finance function within our economies, businesses and in our homes.

Many agree that closing the gap that exists between the evolution and eventual adoption of fintech is critical to advancing economies and businesses. However, the way in which this happens has not always been a clear case. In this vein, the Commonwealth Secretariat created a Fintech Toolkit as a guide for senior leaders and their teams to help them understand the building blocks of fintech and to identify best-suited policy interventions and implementation procedures.

The TTIFC partnered with the Secretariat to bring the learnings of the toolkit along with world-leading experts in fintech development and implementation to local fintech policymakers and industry stakeholders on 17 – 19 May 2022.

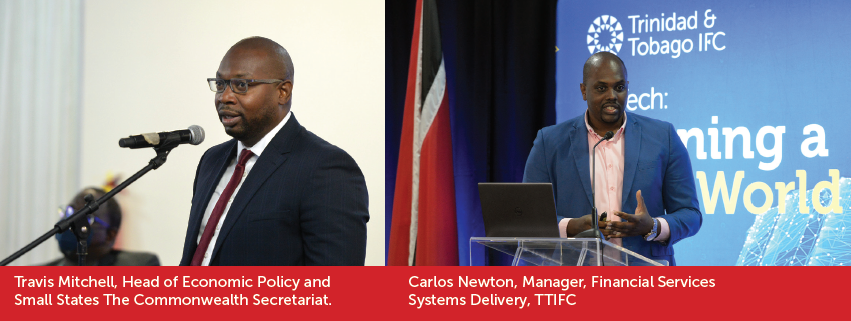

The three-day workshop featured contributions from Travis Mitchell, Head of Economic Policy and Small States and Akeem Rahaman, Economic Adviser of the Commonwealth Secretariat, global Fintech expert and consultant David Shrier, and Kevan Rajaram of PWC, who explored details of the Fintech Toolkit and the implications of Big Data in economies like T&T.

Day two explored the concepts and practices of financial supervision, digital trade and fintech applications in the public sector. Speakers Vashti Maharaj, Adviser Digital Trade Policy for the Commonwealth Connectivity Agenda, spoke on the possibilities and uses of fintech in trade. Erika Piirmets, Digital Transformation Adviser of the e-Estonia Briefing Centre, explained the steps involved in the transformation of Estonia’s public sector and economy.

Day three of the workshop delved into the country experiences of Kenya and the Eastern Caribbean while exploring the local regulatory landscape with contributions from Alister Noel, Senior Manager, Operations of the Central Bank of Trinidad & Tobago and Sugrim Mungal, Manager of Policy Research and Planning at the Trinidad and Tobago Securities and Exchange Commission.

The workshop achieved all the goals set out by the TTIFC and the Commonwealth which included:

- Providing technical guidance on fintech and fintech applications, including using fintech to achieve development outcomes.

- Setting out a framework for creating enabling environments for fintech, including appropriate legislation, regulation, institutions, and policies; and

- Building fintech capacity among stakeholders in the public sector.

The TTIFC is committed to building meaningful public-private sector partnerships with stakeholders in financial services sector transformation, fintech services, and product development to expand our local capabilities in digital financial services and support activities that will lead to increased financial inclusion.

Join the TTIFC as we work towards transforming the financial services sector and building a strong, vibrant, and inclusive cashless economy in Trinidad and Tobago.

Read the full version of the Quarterly HERE or read about Contributions From The FinTech Community.