The increased need for and dependence on cashless transactions continues to reshape how our economy functions and how people interact with financial payment products and services. It is, therefore, expected that citizens will question what measures and safeguards are in place to ensure that the benefit of cashless transactions will outweigh any perceived disadvantages. Given that Parliament plays the crucial role of enacting laws while updating policies and regulations related to cashless transactions, let’s take a closer look at four important areas that the Government has been closely monitoring: digital financial inclusion, transaction fees, consumer protection laws, as well as oversight and accountability.

Promoting Digital Financial Inclusion

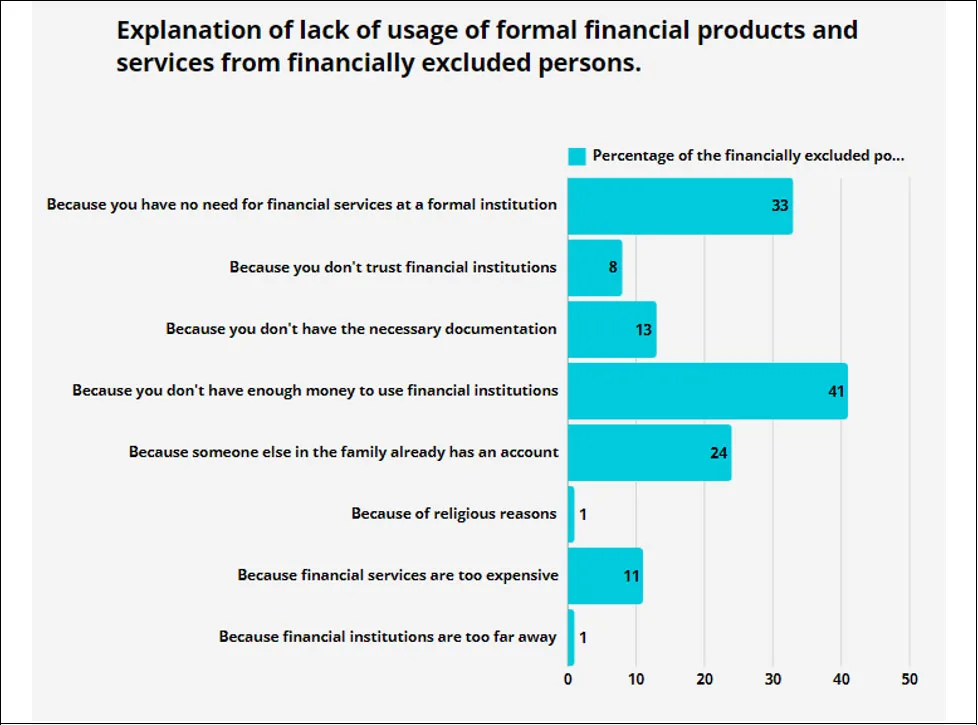

Promoting digital financial inclusion (DFI) is key to empowering excluded communities, boosting economic growth, and ensuring financial security. DFI focuses on providing financial products and services to individuals not part of the formal banking system. This is accomplished through adopting digital payments, FinTech enablement, and financial inclusion strategies, which have been crucial for governments in closing the financial exclusion gap.

Moreover, hand in hand with the rise in digital financial payment methods comes the need for increased digital financial literacy efforts. Many persons who were once financially excluded may not have utilised such solutions before and are often uninformed about features of digital finance that allow for budgeting, savings and appropriate cybersecurity practices. The Trinidad and Tobago International Financial Centre (TTIFC) collaborates with various entities, like the Central Bank of Trinidad and Tobago (CBTT), to develop and implement educational resources to support digital financial literacy. By incorporating digital financial education into the CBTT’s National Financial Literacy Programme (NFLP), such educational interventions can encourage and guide the use and uptake of these technologies.

Nonetheless, as digital financial inclusion is addressed, the appropriate regulatory bodies must maintain oversight and accountability for digital or cashless transactions.

Oversight and accountability

Oversight and accountability in digital transactions in Trinidad and Tobago are essential to fostering trust, security, and economic growth as the country advances towards a cashless economy. However, the activities of a digital financial economy present challenges, including fraud, data breaches, and lack of regulatory compliance. To combat this, transparency is necessary through processes and adherence to international standards, such as those set by the Financial Action Task Force (FATF).

An example of strong oversight and consumer protection in the digital financial economy is India’s Unified Payments Interface (UPI) system. Through the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI), the Indian government has established robust oversight mechanisms to prevent fraud, ensure compliance with cybersecurity standards, and protect consumer data. Similarly, in Trinidad and Tobago, the Financial Intelligence Unit (FIU) and CBTT provide effective oversight with robust monitoring systems to ensure transactions comply with laws like the Electronic Transactions Act and the Proceeds of Crime Act.

Enhanced collaboration among regulators to push new policies and require Parliament to enact laws will ensure secure and inclusive cashless transactions, paving the way for sustainable development in Trinidad and Tobago’s evolving digital financial landscape.

Capping Transaction Fees

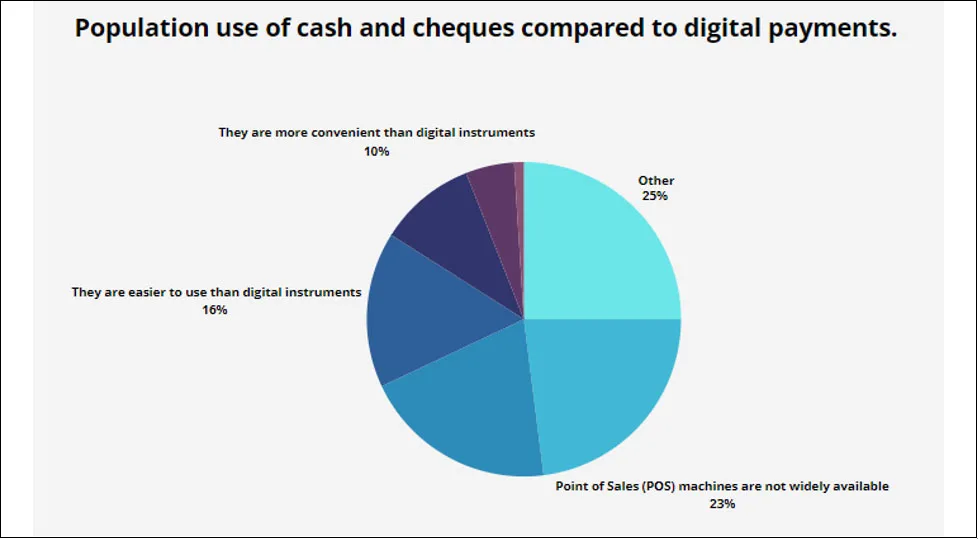

As economies transition toward digital transactions, concerns about associated fees are growing. While cash transactions generally do not involve direct transaction fees, they may entail costs related to physically accessing a merchant or individual to complete the transaction. Sometimes, these costs (for example, commuting and time lost standing in long lines) can surpass those of digital transactions.

World Bank Group (2015). How to Measure Financial Inclusion. See link: https://www.worldbank.org/en/topic/financialinclusion/brief/how-to-measure-financial-inclusion The National Financial Literacy Programme (NFLP). See link: https://www.nflp.org.tt/page22.html

Figure 1 | Use of cash among financially excluded populations in Trinidad and Tobago.

The National Financial Inclusion Survey Report (2023)

In 2016, the CBTT initiated an effort to gather and publish essential fees from the eight local commercial banks. This Comparative Schedule details fees and charges associated with standard savings and checking accounts, credit and debit card transactions and other banking services. However, CBTT currently does not coordinate the regulation of transaction fees. Approaches from other countries can be adopted to address concerns around transaction costs. The European Union (EU) has an Interchange Fee Regulation (IFR), which caps interchange fees for card payments, setting limits on fees for cross-border transactions within the EU. For example, debit card fees are capped at 0.2% of the transaction value, and credit cards at 0.3% (Regulation (EU), 2015). These caps aim to lower costs for consumers and encourage digital payments. Countries like India, Australia and Brazil have also implemented different approaches to control and monitor transaction costs.

As the Government of Trinidad and Tobago (GoRTT) has set financial inclusion as a national priority, the regulation of transaction fees for basic accounts is expected to be a priority. It is currently scheduled as a proposed action item within the National Financial Inclusion Strategy Roadmap, with collaboration among the CBTT and other financial regulation bodies.

Strengthening Consumer Protection Laws

Changes in payments and financial infrastructure call for more tailored terms, regulations, and supervision processes that ensure fair competition among providers and safeguard consumers.

European Union (2015), Regulation 2015/751 – On interchange fees for card-based payment transactions. See link: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32015R0751

These challenges associated with consumer protection are not isolated to Trinidad and Tobago only. Regionally and internationally, economies that have faced similar hurdles have undergone various amendments to current regulations to address these concerns. For instance, the EU enforced its ‘Payment Service Directive 2 (PSD2)’ regulation in 2016 with the objective of “enhancing security of payment transactions and protection of consumer data.” The regulation mandates that all unauthorised transactions must be refunded immediately, security requirements must be in place to safeguard consumers’ financial data, and clear information on account and transaction terms/fees must be shared with clients. Similarly, a bit closer to home, in Mexico and Peru, Key Facts Statements (KFS), as enforced by regulators, are required by financial institutions to provide customers with concise details on financial products to help customers make informed decisions.

Like many other countries, our consumer protection regulations and laws must be a priority within Parliament to stay in line with the rapid technological and financial advances.

European Central Bank (2018) The revised Payment Services Directive (PSD2) and the transition to stronger payments security. See link: https://www.ecb.europa.eu/press/intro/mip-online/2018/html/1803_revisedpsd.en.html World Bank (2017), Can key facts statements outperform financial education? See link: https://blogs.worldbank.org/en/allaboutfinance/can-key-facts-statements-outperform-financial-education

Conclusion

Trinidad and Tobago’s shift toward a digital financial economy offers significant benefits, including efficiency and financial inclusion, but requires focused efforts on regulation and innovation. Key areas like transaction fees, consumer protection, digital inclusion, and oversight are essential for ensuring equitable access and security. Drawing lessons from global examples such as India’s UPI system and the EU’s financial regulations, local initiatives by the CBTT, MTI, and TTIFC demonstrate the nation’s commitment to a transparent and inclusive system. With collaboration, updated legal frameworks, and citizen education, Trinidad and Tobago can build a secure and thriving digital financial ecosystem for all.