Governments worldwide, including Trinidad and Tobago, have pledged to achieve sustainable development by 2030, with poverty reduction as a central focus. The Ministry of Finance (MoF) through the Trinidad and Tobago International Financial Centre (TTIFC), has committed to promoting greater financial inclusion for all citizens—in particular, the underbanked, unbanked, and vulnerable groups—through initiatives designed to increase access to knowledge and technology.

Improving financial inclusion is key to enhancing household welfare, supporting livelihoods, improving equality, job creation, and growth locally, regionally, and throughout the world.

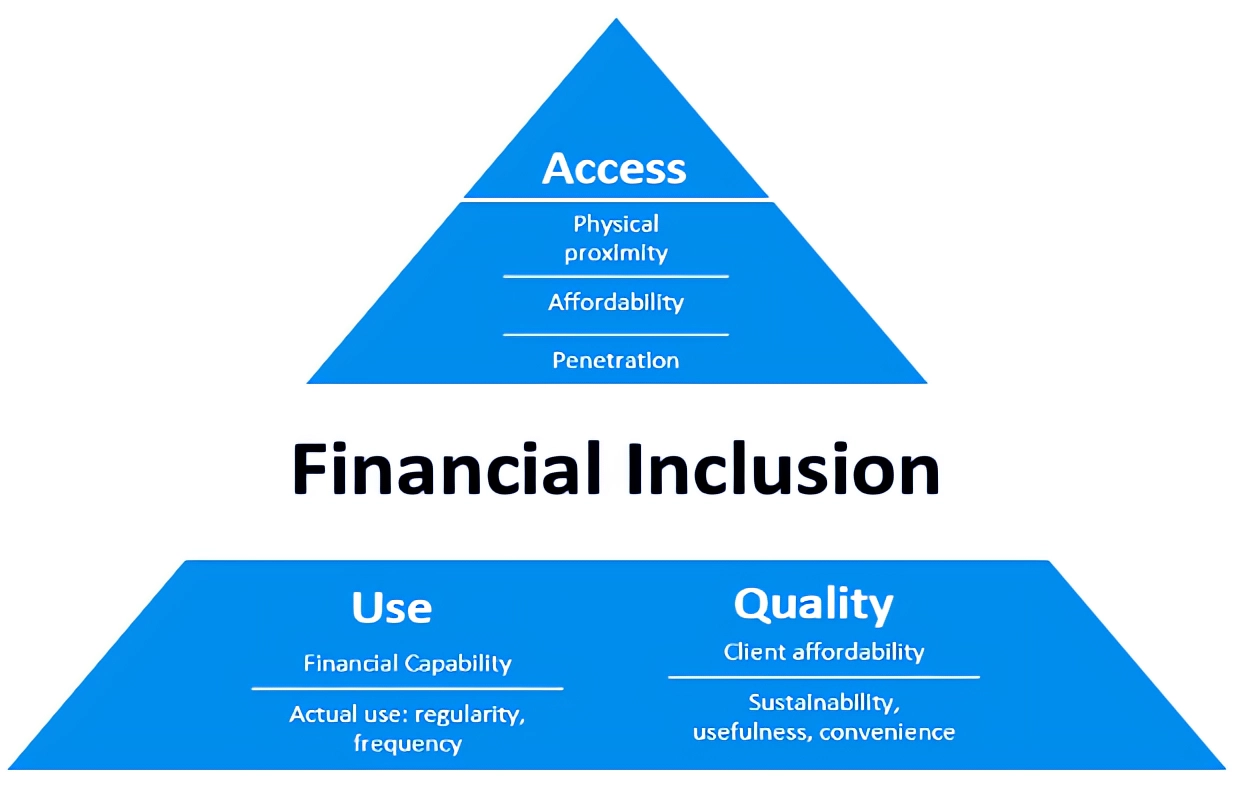

Financial inclusion is a multidimensional concept that refers to individuals and businesses that have access to useful, sustainable, and affordable financial products and services that meet their transaction, payment, saving, credit, and insurance needs (World Bank, 2020).

The full benefits of financial inclusion can only be realised if there is full use of available services and this requires voluntary participation by citizens, through a combination of account ownership and account usage.

In countries, such as Trinidad and Tobago, where account ownership stands considerably high at 80%, the World Bank supports increasing account usage as the next step.

The TTIFC is actively working to provide a greater understanding of the local financial landscape, to not only increase usage but to reduce exclusion and disparities in access to and use of financial services in Trinidad and Tobago.

Key Initiatives

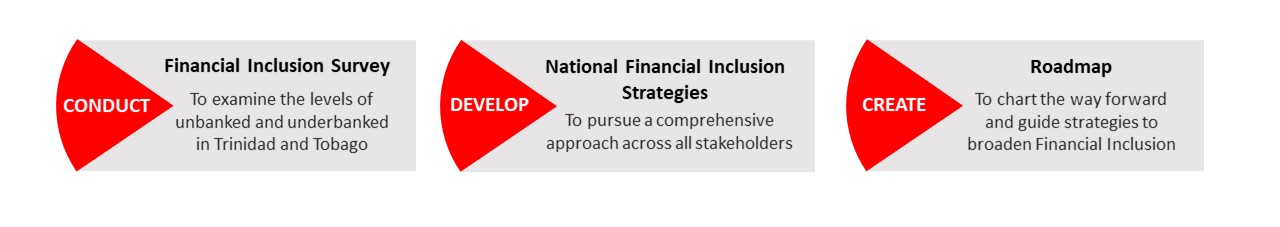

The TTIFC’s Approach to the Promotion and Advancement of Financial Inclusion

Financial Inclusion Survey will be utilised to collate valid, reliable, and up-to-date statistics to fill existing data gaps. Country-level data is key to the performance of diagnostic assessments to inform the design of a National Financial Inclusion Strategy. Data allows us to better understand where we stand, how far we have come, and the discovery of where we need to be.

Financial Inclusion Survey will be utilised to collate valid, reliable, and up-to-date statistics to fill existing data gaps. Country-level data is key to the performance of diagnostic assessments to inform the design of a National Financial Inclusion Strategy. Data allows us to better understand where we stand, how far we have come, and the discovery of where we need to be.- National Financial Inclusion Strategies will outline country-specific initiatives designed to remove barriers necessary to help strengthen the countries’ overall financial systems and expand financial inclusion. This practical set of actions would underpin international best practices and set national financial inclusion goals and targets which are useful for monitoring and evaluation.

- The roadmap will guide the sequencing, timeline, and processes, for the implementation of the National Financial Inclusion Strategies alongside stakeholders at the national or subnational level.

Resources

- World Bank. The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution. https://youtu.be/nKpcAFpIBG8

- IMF Institute Learning Channel. What is financial inclusion and why is it important? https://youtu.be/5eSg1Q6hfd8

- IEG WorldBankGroup. Financial Inclusion – A Foothold on the Ladder toward Prosperity? https://youtu.be/4jH7A0LORGQ

- IMF Institute Learning Channel. What does Fintech mean for financial inclusion? https://youtu.be/S89mtpof6cg