January 21, 2025 | Category: In the News/Media Releases

How microfinance supports T&T’s entrepreneurs

Micro, small, and medium-sized enterprises (MSMEs) in Trinidad and Tobago (T&T) struggle to access traditional financing, with only one in ten securing loans from local banks. A recent Trinidad and Tobago International Financial Centre survey shows that 77% of entrepreneurs lack business bank accounts, creating an estimated $17 billion financing gap for MSMEs. In response, Microfinance Institutions (MFIs) have emerged as crucial resources, providing tailored financial services and business management to underserved communities.

ONLY one in ten micro, small and medium-sized enterprises (MSMEs) can secure financing through the local traditional banking system. The recent Financial Inclusion Survey conducted by the Trinidad and Tobago International Financial Centre (TTIFC) indicated that 77% of entrepreneurs and self-employed individuals had no business bank account. The World Bank estimates the difference between the financing needs and access to these funds for MSMEs in Trinidad and Tobago (T&T) is approximately $17 billion. Thus, a significant financial gap exists between what is needed and what is available. In recent times, however, the emergence of Microfinance Institutions (MFIs) has begun to fill this gap.

MFIs provide financial services, primarily loans, targeted to those underserved by the traditional infrastructure. They are often designed to serve the financial needs of low-income individuals, focusing on marginalised communities. MFIs complement this financial support with training programmes in financial literacy, business management, and technical skills to ensure that loans are used effectively.

Local examples include Term Finance SME, which focuses explicitly on MSME lending, while others such as Island Finance and Courts Finance focus on consumer lending.

Why is Microfinancing Essential for Empowering MSME Potential?

Why is Microfinancing Essential for Empowering MSME Potential?

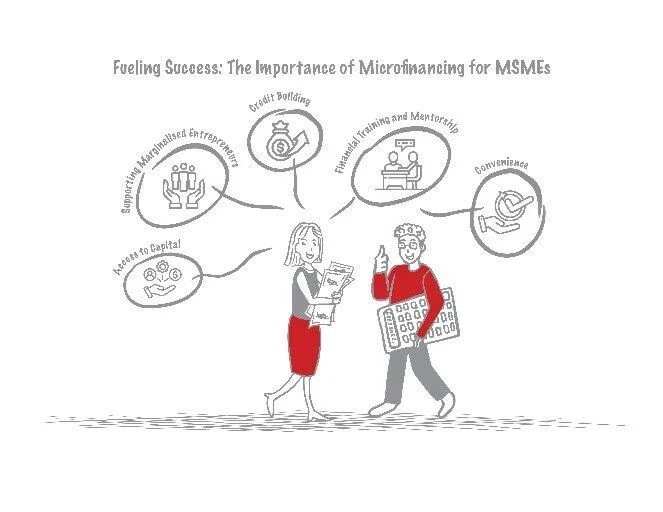

- Providing Access to Capital: When formal financial services are out of reach, these institutions bridge the gap by offering loans that enable individuals to launch businesses, expand existing enterprises, and invest in new opportunities. Many of these businesses are in sectors like agriculture, retail, and services, where small amounts of capital can make a huge difference.

- Supporting Marginalised Entrepreneurs: Whether due to socio-economic status or a plethora of demographic reasons, most local entrepreneurs will attest to their difficulty in accessing business financing. In one regional study, even with identical applications, women were 18% less likely to receive a loan than their male counterparts. MFIs are helping to right this wrong, with 63% of regional microfinance recipients being women.

- Credit Building: How does one build a credit history without a loan, and how does one get a loan without a credit history? Studies have shown that approximately 45% of MFI loans are extended to first-time borrowers, whereas traditional banking loans to first-time borrowers sit below 10%. Entrepreneurs can, therefore, start their credit journey at MFIs, building their credit history and eventually graduating to traditional banking.

- Availability of Financial Training and Mentorship: Beyond lending, MFIs often provide training programmes that equip entrepreneurs with the skills needed to manage their finances and grow their businesses. This support helps ensure that loan recipients can use the funds effectively and sustainably, reducing the risk of default and promoting long-term economic stability.

- Convenience: MFIs are often innovative and leverage the benefits of technology throughout the process. In the best-case scenario, it is estimated that securing MSME funding from a bank can take 8 to 12 weeks, even if suitably qualified. With business opportunities often time-sensitive, MFIs offer a quicker decision turnaround, often in less than a week. With less cumbersome and often digital application platforms, MFIs can provide access to much-needed funding months before the traditional system.

The positive effects of MFIs extend beyond individual borrowers. By enabling the establishment and growth of small businesses, MFIs contribute to local job creation, increased household income, innovation and poverty reduction. These businesses, though small in scale, often serve as the backbone of local economies in developing regions, providing essential goods and services to their communities.

Strengthening Microfinance: Policy and Regulatory Needs

MFIs, therefore, provide significant benefits at the micro and macroeconomic levels. What can be done to enable the establishment and growth of local MFIs? First, progressive regulations and policy should be at the fore. Most local MFIs operate under the Money Lenders Act, first enacted in 1932. The Act sets interest rate ceilings for loans not exceeding $25, $50 and $100. These amounts are outdated, while an interest rate ceiling undermines the MFI’s ability to achieve commercial sustainability.

The role and function of the National Entrepreneurship Development Company Limited (NEDCO) should also be re-examined as its existence and current mandate crowd out private companies. A review of the 2008 to 2014 performance of NEDCO indicated that 77% of loans were non-performing. Expecting private micro-finance lenders to flourish when more than three out of every four borrowers never repay the state-owned competitor is foolhardy.

This brings us to another enabler of MFIs: the enforcement of contracts. With T&T ranking 174 out of 190 countries (World Bank Ease of Doing Business rankings) in enforcing contracts, more must be done to ensure lenders can recoup the funds they extend. Establishing a local business credit rating bureau, specialised courts dealing with debtor matters, and stricter penalties for default should all be considered.

By empowering small businesses, MFIs promote financial inclusion and innovation, alleviate poverty, aid in economic development by creating jobs and championing the marginalised. As microfinance continues to evolve and expand, its impact on our economy is set to grow, offering hope and opportunity to those who need it most.

Building Resilience: Actionable Recommendations for Microfinance Institutions

- Update regulations governing MFIs to reflect current market conditions.

- Remove interest rate ceilings and let market forces prevail.

- Change the role of the National Entrepreneurship Development Company Limited (NEDCO) from lender to guarantor, facilitator and educator.

- Enhance the financial literacy of citizens.

- Develop a credit bureau for businesses.

- Provide tax incentives for SME lending.

- Improved enforcement of commercial lending contracts.

Dr Christian Stone

Chief Executive Officer,

Term Finance SME

Source: trinidadexpress.com